Setting Up An Automated Betting Portfolio

One of the first things that you’ll likely have noticed upon joining Predictology is the breadth of betting and trading options.

It will also make life easier for you as you can be laser focused and experience less swings in your betting profits and bank. A large portfolio is helpful, but also requires a much bigger bank to cope with the wider possible swings in performance.

The purpose of this guide is to give you a suggested starting point. We say suggested as everyone is different, with different requirements, different financial situations and risk profiles. You can, however, hopefully use this as a foundation or guide to building your own mini portfolio.

A couple of additional points to keep in mind before we get into this.

– 1. We strongly recommend including the Daily Best Bets in your portfolio approach, even though they are not ‘automated’

– 2. We tend to advise allocating separate budgets for back models and lay models.

For example, if you had £1,000, would split this into two banks for £500 and then apply percentage staking / compounding to each individual bank.

he full BF Bot Manager Strategy files and an easy to follow guide to setting these up for automation and bet placement.

Betting Portfolio – Our Objectives

When ever you are developing a betting strategy or portfolio, it is important to have the outline of plan before you begin.

- Betting Portfolio: High Strike Rate

We understand, particularly when starting out, it’s important to build the confidence that regular winners can provide. This means we ruled out more of the “value” models which, although profitable are more likely to have a strike rate around 30%.

So our cut off was 40% and ideally in most cases, we would have a strike rate of 50% or higher.

- Betting Portfolio: Blended or Not Blended Bets

A blended portfolio would look to include a range of bet types including Win, Lay (match and draw) and Goal markets.

For this portfolio, we will be focusing solely on back bets and goal markets to keep volume of bets at a reasonable level.

Adding lay bets would certainly be a key next step if expanding out this portfolio in future.

- Betting Portfolio: Smooth Downswings and Profit Progression

Lay bets can often make for a smooth trend graph until they hit a loser which causes more short term volatility in downswings due to the nature of lay bets and the liability side of the bet.

By focusing on back bets, with high win rates, we should have a fairly stead graph pointing up and to the right.

Betting Portfolio: Flexible

We have chosen to focus on the Match Shortlists for our mini portfolio as this allows for a variety of complementary strategies with lots of live data. They use a combination of pre-match and in-play strategies to maximise returns while keeping bet volume at a reasonable level to get you started and ensure you are not overwhelmed initially.

Portfolio Strategy Inclusions

– Match Shortlists – Over 3.5 Goals – Back Over 3.5 Goals

Low volume but very accurate goal betting model. It has been delivering an 8.5% ROI for more than two years now.

– Match Shortlists – First Half Goals – Back 1+ Second Half Goal

Another reliable model that targets at least one additional goal in the second half, thanks to the Match Shortlist for First Half Goals.

– Match Shortlists – Exposed Home Favourite – Back Draw if 0-1

– Match Shortlists – Exposed Home Favourite – Back Home Win if 0-1

We have combined these together as two profitable strategies that work well in conjunction with each other, while requiring different entry points and match statuses.

– Match Shortlist – Home Win – HT Win

– Match Shortlist – Home Win – Back Win in Second Half if drawing

Again, two strategies that combine well together and maximise returns on the Home Win shortlist. It is quite possible to collect on both strategies within the same game and happens fairly frequently.

Setting Up Your Portfolio

We are going to assume that your plan is to automate these selections with BF Bot Manager as we are in the Automation section of the Launchpad.

These models can be done manually but would require you to be at the computer to live bet many of them so it may not be the most optimal approach for you if that is what you are planning.

The following steps will show you how to set this portfolio up – again, we’ll assume that you have gone through the process to actually connect Predictology to BF Bot Manager for Automation.

– 1. Strategy Files

You can download the BF Bot Manager Strategy files to upload to the Bot here.

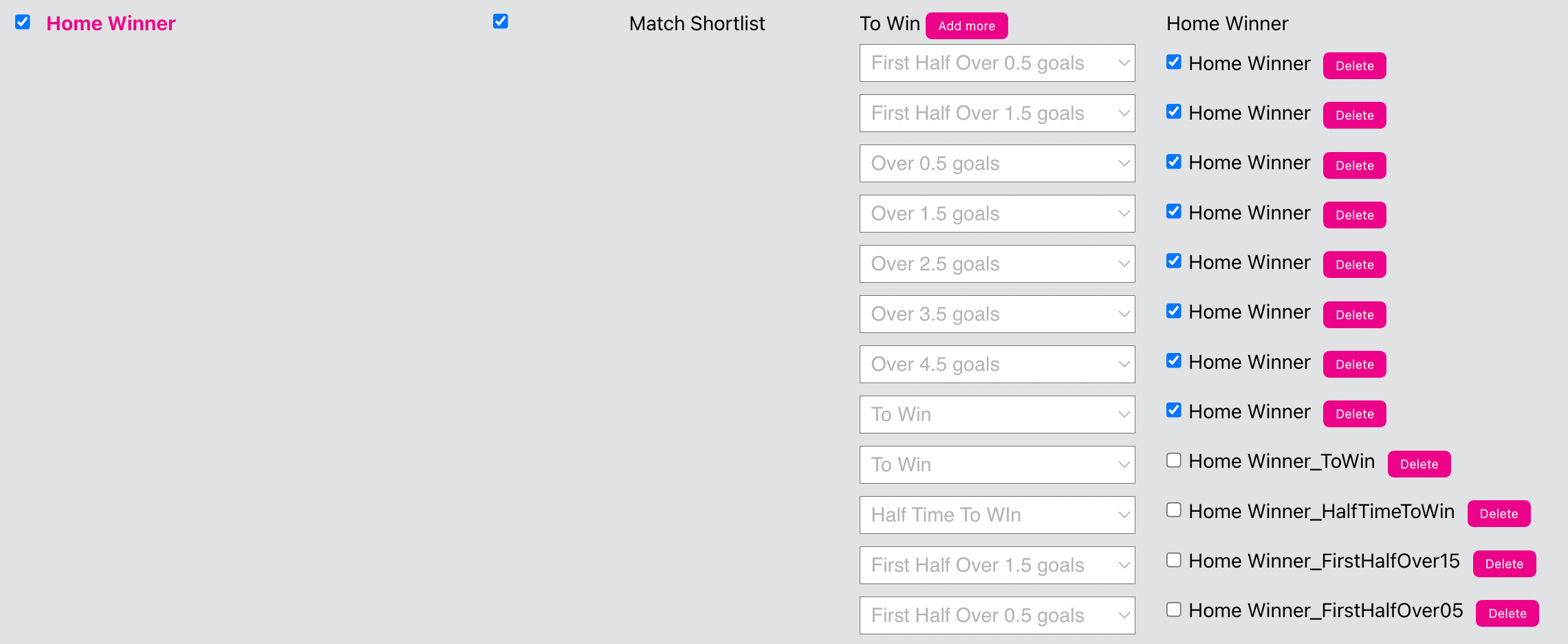

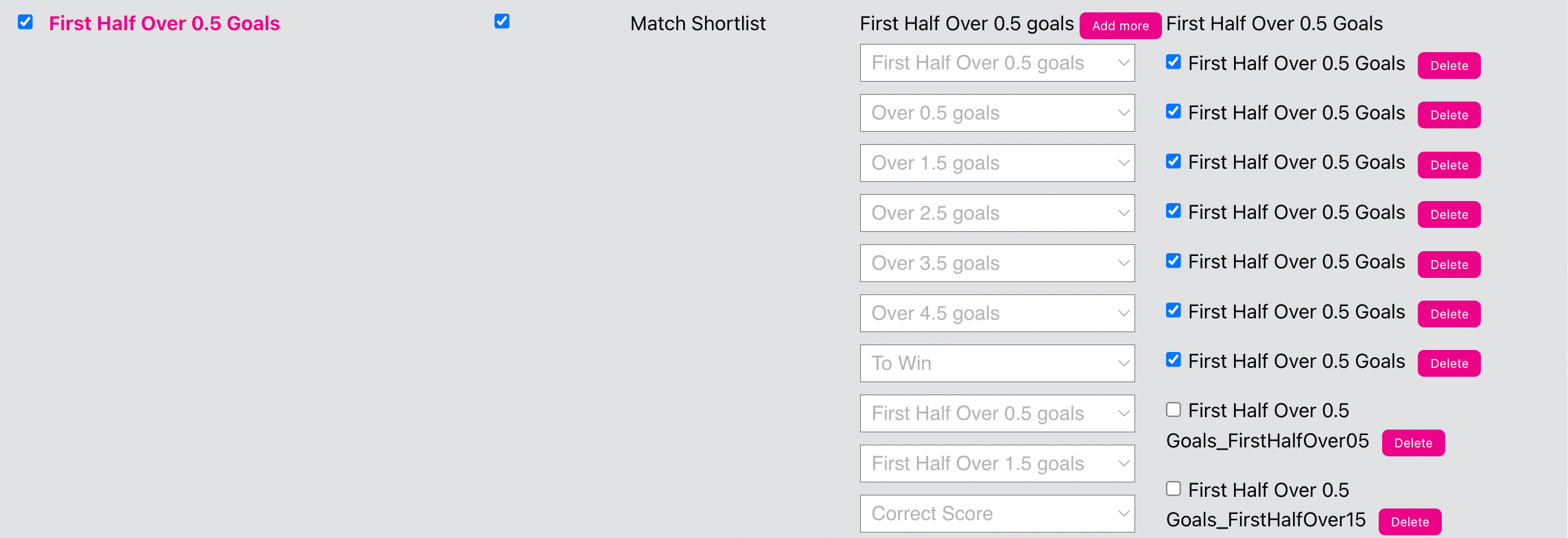

– 2. Setup the Markets For The Feed

Go to the Predictology Automation Connections page here

Your settings will need to look like the following: