An asset class is a group of investments with similar traits and are subject to the same regulations and laws. Therefore, an asset class comprises instruments that behave similarly to each other in the marketplace. Well-known asset classes include:

- Real estate

- Cash and cash equivalents

- Equities (stocks)

- Fixed income (bonds)

- Commodities

- Currencies

- Cryptocurrencies

Can Betting also be treated as an Investment Class?

Betting: A New Investment Class?

Financial advisors look at asset classes as a means of helping clients embrace the diversification of their portfolios. As asset classes are supposedly uncorrelated, you can create a broad portfolio and protect your overall investment. Even if a couple of asset classes perform poorly over the short to medium term, others within the portfolio are likely to pick up the slack and keep your profit ticking over.

Sports betting/trading IS an asset class and belongs in the conversation with the others mentioned above. It has many advantages, and there are solutions to its downsides. This article outlines why you should take betting/trading seriously when considering how to invest your hard-earned money. It outlines the benefits, compares the ROI to other forms of investment, and provides advice on overcoming the obstacles you’ll face.

Should Betting Be A Part Of Your Investment Portfolio?

According to Bloomberg, the global sports betting market will be worth over $140 billion by 2028. While this is a drop in the ocean compared to other investments (hedge funds are worth almost $4 trillion, for example), it is clear that the industry is stepping out of the shadows.

No longer is it primarily associated with desperate men crowded in a bookmaker’s shop hoping that their 25/1 shot will somehow win at Kempton. It is now seen as a legitimate form of investment. So much so, organisations such as Sporttrade offer investors the opportunity to get involved as they would the stock market.

The platform enables people to trade sports predictions with each other. You can buy and sell bets during an event at different odds to make a profit. Of course, UK punters will immediately notice the similarities between Sporttrade and the Betfair Exchange.

In the modern era, data is king, and people use software such as what Predictology offers to get a long-term edge over the bookmaker.

According to Bloomberg, the global sports betting market will be worth over $140 billion by 2028. While this is a drop in the ocean compared to other investments (hedge funds are worth almost $4 trillion, for example), it is clear that the industry is stepping out of the shadows.

No longer is it primarily associated with desperate men crowded in a bookmaker’s shop hoping that their 25/1 shot will somehow win at Kempton. It is now seen as a legitimate form of investment. So much so, organisations such as Sporttrade offer investors the opportunity to get involved as they would the stock market.

The platform enables people to trade sports predictions with each other. You can buy and sell bets during an event at different odds to make a profit. Of course, UK punters will immediately notice the similarities between Sporttrade and the Betfair Exchange.

In the modern era, data is king, and people use software such as what Predictology offers to get a long-term edge over the bookmaker.

Beating Hedge Fund Returns Through Betting

To the punter who believes that the bookmaker always wins, the suggestion that it’s possible to earn an ROI akin to, or even better than, what one achieves via ‘traditional’ investments seems absurd. However, that’s precisely what professionals can do.

The idea of sports betting becoming a new asset class is hardly new. Gomber, Rohr, and Schweickert wrote about the concept as early as 2008.

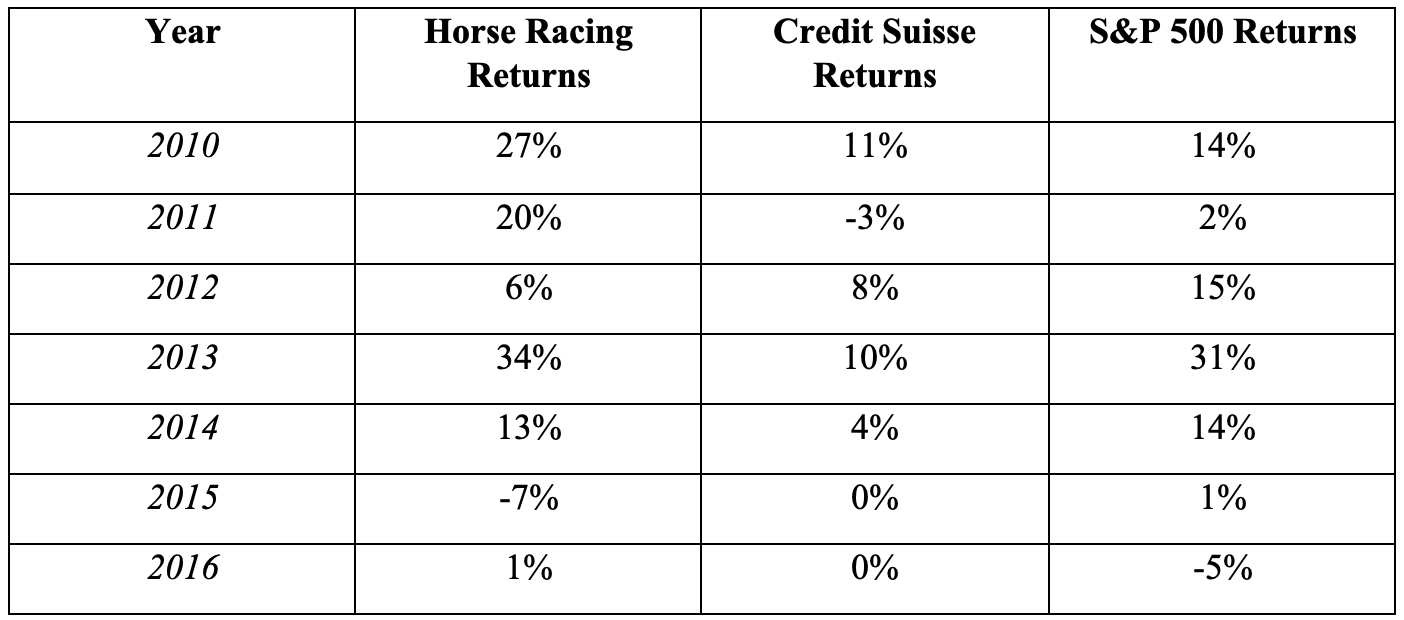

A study published in 2016 by Thukral and Eleuterio looked at whether a sports trader could beat a hedge fund manager. The researchers decided to lay the four horses with the lowest odds (the top four horses in the betting market) in select races where they believed there was an edge.

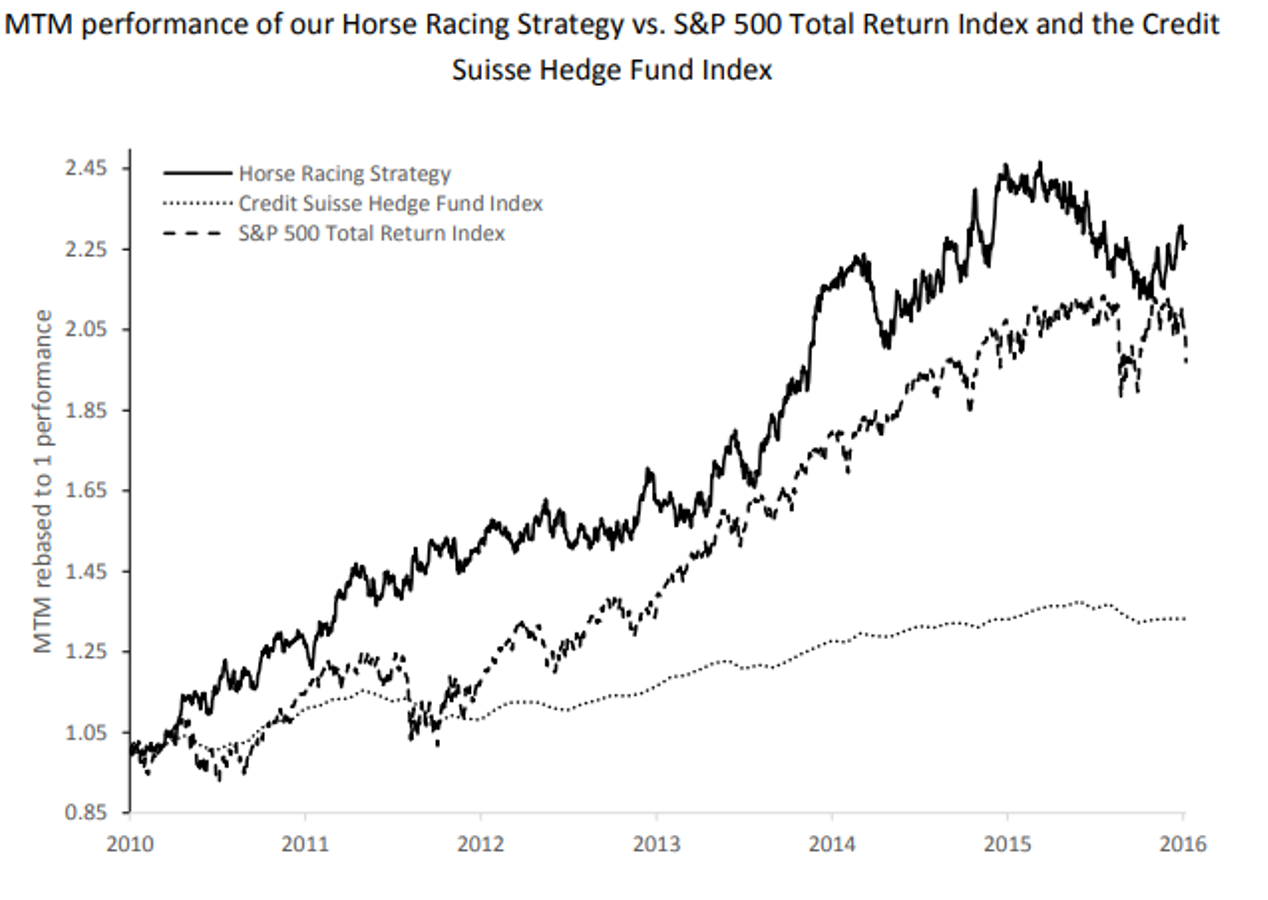

Overall, they made 228,000 bets on 57,000 races from January 1, 2010, until January 7, 2016. They compared the returns to what an investor would have achieved on the Credit Suisse Hedge Fund Index and the S&P 500.

*source: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2794937

As you can see, the horse racing traders outperformed both ‘conventional’ investments across six years. All three had lengthy periods of volatility, so it is a myth to suggest that standard investment forms offer positive linear returns.

The above study also involves a relatively simple system. A slightly more sophisticated one could, in theory, result in even higher returns.

What are the advantages and disadvantages of sports betting as an investment class? Let’s find out.

Betting As An Investment Class: Low Barrier To Entry / Possibility of Higher Returns

Hedge funds have enjoyed an excellent recent spell with an ROI of 10+% in 2019, 2020, and 2021 following a small loss in 2018. However, there is an extremely high barrier to entry for most funds.

For instance, in the United States, you need a net worth of over $1 million or have an income of more than $200,000 per annum for the previous two years plus the year you intend to begin investing. This, of course, eliminates all but a small percentage of people.

Other options include investing in the FTSE 100, which has provided an annual total return of 7.8% from 1984 to 2019. Someone who invested £10,000 in 1986 would find that their investment would have grown to over £195,000 had they reinvested any dividends received.

Using a sensible sports betting portfolio, one could enjoy a healthy ROI and an enormous Return on Capital (ROC) using the example of reinvesting dividends in the FTSE100 above. It is possible to do this with a relatively low starting bank, especially if you begin with a high-win rate strategy with a relatively small drawdown.

Example Investment Returns From A Betting Asset

Treating sports betting as an investment class means you can begin with a few hundred pounds and watch it grow over the years. Let’s say you adopt a strategy where you plan to make 2,500 bets a year at £20 a wager. If you have a high enough win rate, say 70+%, you can easily begin with a bankroll of £1,000.

With your seemingly meagre bankroll, you ultimately invest £50,000 a year (2,500 x 20). At an ROI of 6%, that equates to a profit of £3,000. In just 12 months, your bankroll has gone from £1,000 to £4,000. At this point, you can bank your initial £1,000 and some profit if you wish and continue with what is now a risk-free investment.

Let’s imagine you’re happy to stick with your strategy but increase the stakes as your bankroll grows. In year two, you again make 2,500 bets, this time at £60 apiece since you have £3,000 to play with (assuming you withdraw the initial £1,000, which you really should). Now you have invested a remarkable £150,000 that year (2,500 x 60). Let’s say the ROI drops to 4%; it still represents a profit of £6,000.

Your initial £1,000 investment is now worth £9,000 in just two years, AND you have withdrawn your initial stake*. It is easy to see how your bankroll can grow over the years. The above is a simple example but hopefully allows you to see the potential power of sports betting as an investment.

Few forms of investing enable you to risk with so much money from a small starting stake, and you can do so with surprisingly little risk to your bankroll.

In the United Kingdom and many other countries, your income from sports betting is tax-free. This is NOT the case with traditional forms of investment.

*It is advisable to withdraw a certain percentage of your profits each month. Not only does it ensure your investment becomes ‘risk-free’ over time, but it is also beneficial psychologically to spend your profits.

Betting As An Investment Class: No Correlation with Other Investments

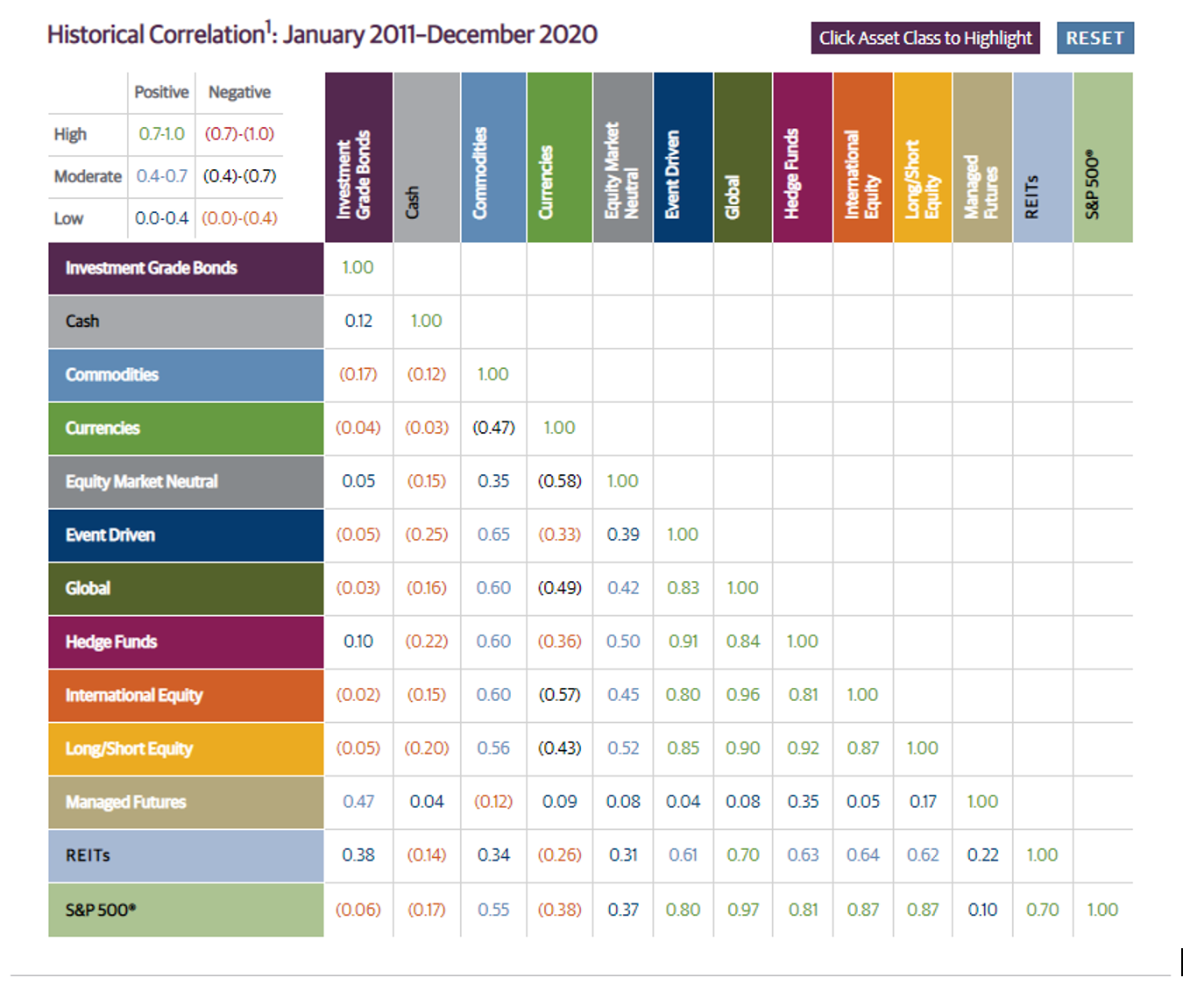

In theory, asset classes should not correlate with one another. In reality, there IS a correlation between certain asset classes, ranging from low to high.

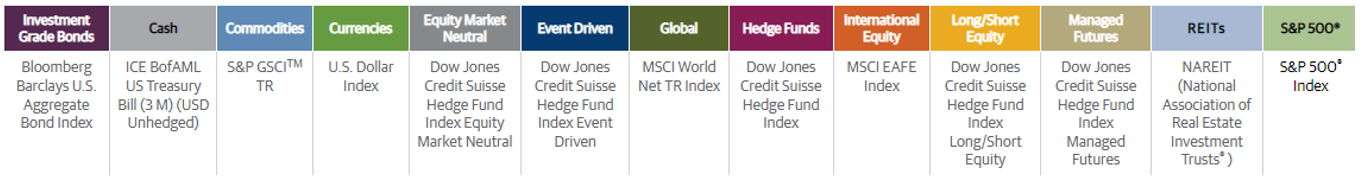

*source: https://www.guggenheiminvestments.com/mutual-funds/resources/interactive-tools/asset-class-correlation-map

In the above screenshots, you can see the correlation between different assets. A score of 1.00 means perfect correlation, while 0.00 means no correlation whatsoever. If an asset correlates with something, its value rises and falls with the other asset/event.

For example, the prices of most of the investment classes above depend on global events. Prices crashed across the board in March 2020 when the global pandemic began. Even cryptocurrencies hailed as an alternative to fiat currency-based investments (yet people buy and sell it for fiat) collapsed with the traditional markets.

The sports betting asset class depends on none of the above. You make a bet or trade on an individual event and win or lose based on what happens. In soccer, for example, you might bet/trade on the winner of a match or the number of goals scored. Geopolitical events have no bearing on the match’s outcome unless they directly impact some players!

With the right strategy and patience, you can earn a steady income, no matter what’s happening in the stock market or the world at large.

Betting As An Investment Class: Potential For True Diversification

Following the Modern Portfolio Theory (MPT) model, the goal of your investment should be to get the best possible returns from the level of risk you assume. MPT is based on risk-averse investments and posits diversification as one of the most important facets of investing.

Creating a portfolio of investments with little correlation to one another is a sensible move. You should dedicate a certain percentage of the money you’re willing to risk to different asset classes. For instance:

- 40% in property

- 3% in crypto

- 17% in cash

- 25% in large-cap stock

- 15% in sports betting

However, you can create a diverse portfolio within the asset class itself when you bet on sport. A basic example is to create 15 strategies with varying win rates, prospective ROIs, and maximum losing streaks and drawdowns.

A risk-averse investor might create:

- Nine strategies with a 70%-win rate and 4% ROI

- Four strategies with a 50%-win rate and 7% ROI

- Two strategies with a 25%-win rate and a 12% ROI.

The low and medium strike rate strategies will have lengthy drawdowns, but the high win ones will provide a slow yet steady profit with lower drawdowns. When you create sensible bankrolls based on reality rather than hope, you could develop a near bullet-proof sport betting portfolio that stands the test of time.

Incidentally, apparently ‘solid’ traditional investments also have long losing periods. For instance, the FTSE 100 has had four drawdowns of over 35% since 1987, three of them since 2003. Between 2000 and 2009, investors would have only earned an annualised return of 0.3%.

Financial experts suggest that you expect the stock market to decline by 30% once every ten years.

Therefore, it is reasonable to expect peaks and troughs in sports betting but remember; your earnings do NOT depend on global events.

In Part 2 of Sports Betting as an Investment Class, we are going to dig deeper into this topic and look at the obstacles and challenges to consider when using Sports Betting as an Investment Class, as well as how you can begin designing your sports betting and trading to become an asset in your investment portfolio.

In the meantime, let us know your thoughts on using Sports Betting as an Investment Class in the comments below.